Not even George Orwell foresaw a time when the topic commanding a large share of media attention would be … the media.

No, not the old-style broadcast and print media. Dominating the headlines these days are media the likes of Facebook, TikTok, WeChat, and, just to round things out, Netflix. All except Netflix have implications for the payments business.

TikTok, WeChat, Facebook, and more

These days it’s almost de rigueur for a congressional committee to scrutinize the social media. Take Facebook, which, along with other social media and search engines, has come under recent fire for allegations of moderating political speech. Ironically, this comes on the heels of its having been under fire for not moderating political speech.

You may also have seen mention in the news of Chinese apps TikTok and WeChat. Brookings summarized the administration’s concerns about the apps this way:

[T]he core American concern appears to be that the Chinese government will be able to access this data and potentially leverage it for espionage or blackmail. U.S. officials also worry the apps censor political speech and could be used to spread misinformation.

Behind the scenes there are several broader motivations likely also contributing to American action against TikTok and WeChat. The move is a significant escalation in ongoing technology tensions between the U.S. and China … It also reflects some officials’ desire for greater reciprocity in the U.S.-China relationship, given that many U.S. technology companies cannot operate freely in China.

Accordingly, Mr. Trump issued executive orders on August 6 banning the use of WeChat and TikTok from within the United States as of September 20. The WeChat ban threatened to deliver a blow in particular to Chinese Americans. According to analytics firm Apptopia as reported by Singapore online news outlet Today, some 19 million Chinese Americans who use WeChat daily fear being cut off from friends and family. And the threatened TikTok ban has caused a stir among Americans in general. According to CNBC, right now more than 100 million American users love them some TikTok.

I used the word threatened because, for the moment, both executive orders are on hold. A federal judge in San Francisco issued a temporary injunction on the WeChat order. According to NPR News,

U.S. Magistrate Judge Laurel Beeler in Northern California issued a preliminary injunction Sunday morning siding with users of WeChat, who claimed in a lawsuit that Trump’s action curbed their First Amendment rights.

And in the United States district court for the District of Columbia, Judge Carl Nichols blocked the TikTok order. The Guardian reported that Nichols …

… granted an injunction against the order after a hearing on Sunday night, citing the argument from [TikTok parent] ByteDance that without an injunction it would suffer “irreparable harm”, even if the ban were eventually lifted.

Meanwhile, first Microsoft and, later, Oracle teaming up with Walmart expressed interest in acquiring and thus ensuring the continuance of TikTok’s U.S. operations. As of this writing, TikTok has rejected Microsoft’s bid and leans favorably toward Oracle-Walmart’s. Of course, there has been enough back-and-forth that it wouldn’t surprise me if that changed within minutes of my uploading this post.

Impact on the payments business

WeChat and TikTok are significant players in the digital payments business. Medium quoted Berkshire Hathaway’s Charlie Munger as saying that WeChat was “one of the few potential competitors to Visa, Mastercard and American Express.”

PaymentsSource speculated that the bans, if they go through, could set up “potential retaliation against U.S. companies that could interrupt international payment flows.” But there will be even more potential impact, PaymentsSource continues,

“… if the Chinese government retaliates, preventing U.S. companies like Walmart, Starbucks, hotels and other merchants from using these nearly ubiquitous apps within China,” said Sarah Grotta, director of debit and alternative products advisory service at Mercator Advisory Group.

Numerous merchants in the U.S. support [WeChat parent company] Tencent’s WeChat Pay and Ant’s Alipay, primarily to allow Chinese consumers to use their own currencies while traveling. That use case is among Tencent and Ant’s major modes of expansion in the U.S., and a ban of any length could reduce payment flows in the U.S. (Ant and Alipay are not part of the ban announced Friday morning.)

Slate weighed in by observing that the Commerce Department …

… will also prohibit WeChat from processing U.S. payments and transferring funds … The same will happen to TikTok on Nov. 12 unless Trump rescinds the ban or the administration approves a deal for a U.S.-based company to take over the app from its Chinese owner ByteDance.

BusinessOfApps reports that as of Q4 2019, over 800 million WeChat Pay users were executing more than a billion transactions daily. In total, WeChat boasts over a billion active users, a little more than half of whom avail themselves of the app’s payment feature. I wasn’t able to track down specific numbers for the U.S., but if anywhere near half of WeChat’s 19 million U.S. subscribers use WeChat Pay, it goes without saying that a ban will have serious implications.

And then there’s Netflix

Netflix is one player in the digital world under recent scrutiny that, mercifully, has nothing to do with the payments business beyond collecting its monthly membership fee. At issue is the movie Cuties, a French-made drama that brought accusations of “criminal sexual exploitation of minors” from Senator Mike Lee (R-Utah) and others. So far, Netflix is standing by the film.

Perhaps WeChat, Tiktok, Facebook, Google and others should thank Netflix for diverting some of the negative attention from them. For now.

MOST AMERICANS would gladly opt out of their long-term relationship with the Internal Revenue Service. To that end, a good many of us pay CPAs to ensure we don’t give the IRS one penny more than we must.

So when sundry people and corporations manage to avoid paying billions in arguably due taxes, you’d think we might celebrate them as rebels for our cause. We don’t. We make of them objects of scorn. Willingly or not, if we have to cough up, we reason, so should they. Else, we are carrying their load.

Readers may recall hotel magnate Leona Helmsley, who with her husband was convicted of tax evasion in 1989. It seemed the Helmsleys had written off $8 million under hotel maintenance expenses which they had in fact spent remodeling their private, 21-room mansion. At trial, the Helmsleys’ housekeeper famously testified to having heard Leona say, “We don’t pay taxes. Only the little people pay taxes.”

The Helmsleys broke the law, but even legal tax evasion can get up the public’s dander. Perhaps you have heard the words “tax return” bandied about with reference to a certain presidential candidate. The accusations of “not paying taxes” do not include a reference to fraud—although perhaps some raising the hue and cry would gladly let you infer as much—but rather that it simply ain’t fair.

Apple, Inc. should be pleased.

The noise of the election tax issue has to an extent diverted attention from Apple’s recent, alleged abuse of international tax laws. Apple took advantage of what is colloquially known as the Double Irish Arrangement, which essentially consists of setting up a company that doesn’t really exist in any particular place along with a nominal presence in Ireland to meet minimal tax obligations.

The European Commission was not amused. In an August 30 press release, the Commission wrote:

… most profits were internally allocated away from Ireland to a “head office” within Apple Sales International. This “head office” was not based in any country and did not have any employees or own premises. Its activities consisted solely of occasional board meetings. Only a fraction of the profits of Apple Sales International were allocated to its Irish branch and subject to tax in Ireland. The remaining vast majority of profits were allocated to the “head office”, where they remained untaxed.

Therefore, only a small percentage of Apple Sales International’s profits were taxed in Ireland, and the rest was taxed nowhere. In 2011, for example (according to figures released at US Senate public hearings), Apple Sales International recorded profits of US$ 22 billion (c.a. €16 billion) but under the terms of the tax ruling only around €50 million were considered taxable in Ireland, leaving €15.95 billion of profits untaxed. As a result, Apple Sales International paid less than €10 million of corporate tax in Ireland in 2011 – an effective tax rate of about 0.05% on its overall annual profits. In subsequent years, Apple Sales International’s recorded profits continued to increase but the profits considered taxable in Ireland under the terms of the tax ruling did not. Thus this effective tax rate decreased further to only 0.005% in 2014 …

The Commission’s investigation has shown that the tax rulings issued by Ireland endorsed an artificial internal allocation of profits within Apple Sales International and Apple Operations Europe, which has no factual or economic justification.

The European Commission has ordered Apple to pay the equivalent of about $14.5 billion US plus interest in back taxes. This is not good news for Apple, even though a Washington Post article opined that “…$14.5 billion in back taxes is just a slice of Apple’s cash stockpile.”

In an open letter on behalf of Apple, CEO Tim Cook stated Apple’s intention to appeal. Meanwhile, the United States has expressed concern that the repayment could unfairly fall upon U.S. taxpayers’ shoulders. Bgr.com’s Chris Mills wrote:

The US Treasury Department has been unusually vocal about this case, in statements last week and also after the ruling was handed down today. Mostly, the Department objects to retroactive taxation, which is says is “unfair, contrary to well-established legal principles, and call into question the tax rules of individual Member States.”

On the other hand, Forbes writer Jeffery M. Kadet argues that, on the contrary, U.S. taxpayers won’t end up picking up Apple’s back tax bill.

Apple isn’t the only multinational hovering over hot water for exploiting international tax loopholes. It is to date simply the most infamous. Last year at this time, the EU ordered Starbucks and Fiat Chrysler to repay in euros the equivalent of about $34 million US apiece. As I write, the EU is looking into Amazon, McDonald’s, and Google, to name a few.

In two weeks, the election will be over and with it, hopefully, its accompanying noise. Perhaps at that time the tax conversation will resume with Apple et al as its focus.

Sep 20

28

Pragmatism and the unwitting fraudster

With National Cyber Security Month upon us in three days, now seems like a good time to revisit the topic of cyber fraud. But rather than focus on the technically proficient cyber-criminal, today I shall focus on people who unwittingly obtain undeserved credits and refunds, aka friendly fraud.

Friendly fraud

Memory, or, rather, the lack of it, is a frequent author of friendly fraud. Most of us have had the experience of reviewing a statement and wondering, “Who the devil is Monoflarb Enterprises LLC and what the devil could I possibly have purchased there for $24?” Then a bit of googling quickly reveals that Monoflarb operates a store you know by another name, where you indeed remember spending $24. But people who aren’t as adept or diligent when it comes to googling may default to contesting what is in fact a legitimate charge.

Friendly fraud also comes in the form of simply forgetting having received an item. Or in the form of an authorized party—a relative, for instance—who makes a legitimate purchase and takes delivery, all unbeknownst to the account holder, who may truthfully claim, “I never shop there.”

While an individual friendly fraudster may not be able to inflict much harm upon a financial institution or merchant, individual cases have a habit of adding up. PYMNTS.com points out that the current pandemic has produced a surge in orders to restaurants offering delivery services and, with it, an increase in friendly fraud …

… especially since many mobile apps come equipped with features or tools that only make it easier for friendly fraudsters to request illegitimate chargebacks or make other false claims. This type of fraud can be equally as costly for QSRs [Quick Service Restaurants] to manage as malicious cybercriminals make it imperative for these entities to keep their mobile platforms secure against such unnecessary chargebacks.

Moreover:

One 2018 report stated that approximately one out of every 100 consumer transactions are targets of this type of fraud … This may seem like a small segment, but it can really push up costs for restaurants, especially for smaller businesses.

The cost

Generous policies allowing customers the benefit of the doubt can make for good customer relations, but they can come with a high price tag. Another PYMNTS.com article states:

A recent study examining the past three years found that online retailers experienced wrongful chargebacks 50 percent more often than they did chargebacks that were in response to criminal activity. This is a costly problem for merchants that often struggle to furnish the evidence needed to successfully dispute the claims and for FIs that must spend time and money investigating charges that never should have been placed.

Chargeback solutions marketer Chargebacks911 concedes the difficulty in pinning down a reliable number. “Issuing banks and card networks,” their website states, “refuse to publish essential data or specific numbers on chargebacks in areas such as dispute win rates.” Besides,

Even if those entities would be willing to share information, they typically don’t keep the kind of comprehensive records needed for a “big picture” view. Similarly, merchants hesitate to release any information regarding chargebacks, fearing the association could harm their reputation.

Notwithstanding, the company estimates that “86% of all chargebacks are probably cases of friendly fraud,” and that “roughly 40% of consumers who commit friendly fraud will do it again within 60 days.”

Pragmatic solutions

It goes without saying that AIs are getting better at detecting and preventing many varieties of fraud, friendly fraud included. But surprisingly obvious, even banal methods within easy reach can produce favorable results.

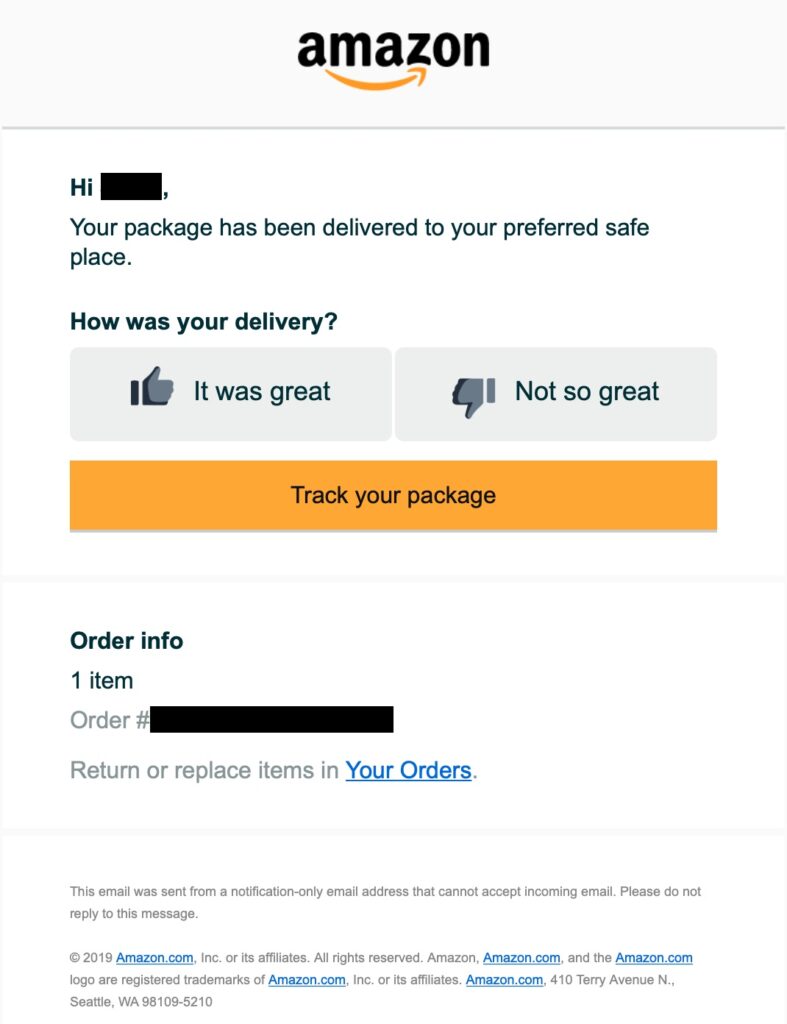

You may have noticed, for instance, that Amazon, Grubhub, and other delivery drivers have taken to texting or emailing delivery notices, increasingly attaching photos of the delivered product contentedly waiting at the customer’s door. That’s an eminently pragmatic solution. Besides confirming delivery, the practice gives an immediate heads-up to clients in the event they genuinely did not place an order.

Another banal solution is to make sure that no customer ever has to google Monoflarb Enterprises LLC in the first place. Merchants need only do a better job of making sure they are identifiable on statements.

Here’s an obvious one: Given the increasing prevalence of smartphones, tablets, wearables, and computers that use biometrics, it only makes sense for payment apps to avail themselves of them. Of course, for big-ticket items, obtaining a signature at delivery is all but a sure-fire means of eliminating friendly fraud.

Not to be underestimated is the power of good, old-fashioned customer service. Chargebacks911 observes, “If customers trust the merchandise, comprehend all delivery and return policies, and are confident the merchant will help resolve any problems, they’re less likely to seek a friendly fraud chargeback.”

Some of the above may seem so obvious as to elicit a “duh” here or there. But one person’s “duh” is often another person’s “aha!”

Sep 20

24

TBT: The Trouble with Daring a Hacker

It has become something of a journalistic fad for reporters to invite hackers to, well, hack them. Without exception, they emerge shaken by two observations: Just how vulnerable they are; and just how much sensitive data they’d forgotten about that awaited discovery.

TIME reporter Joel Stein is one of the latest to give it a whirl. He writes about his experience in his column dated March 23. Unsuccessful at recruiting real hackers—those he contacted may have feared embarrassing him or worried about entrapment—he finally cornered a pair of young staffers at the magazine with no hacking abilities, gave them his passwords, and told them to have at it.

“The advice hackers give when looking for dirt in a pile of data,” Stein says, “is to …

… search for words such as pissed or angry. They suggest figuring out to whom the most emails are sent, since that signals a trusted relationship. And to use Facebook to suss out relationships—ex-girlfriends, college acquaintances—to spot dubious interactions. Deleted photos are telling, as are erased emails. And they say to always, always look in the draft folder, which houses the truly horrible stuff people are too smart to send … Using this advice, my two hackers delivered an 18,000-word document of humiliations three weeks later.”

Three years earlier, Telegraph reporter Sophie Curtis wondered,

… is the threat of being hacked something that you or I really need to worry about? And if someone did hack into your computer, what would they be able to do with the information they found?

Over the summer I decided to put these questions to the test. I got in touch with an ‘ethical hacker’ called John Yeo, who works for cyber security firm Trustwave, and asked him to try and hack me.

Curtis had written a good deal about cyber security, so, she wrote, “most of my profiles are fairly locked-down.” But, not so fast. Her hired hackers found indirect ways of learning more about her. Next, they faked an email appearing to come for LinkedIn, a source she trusted. The mere act of opening the email—without clicking links—embedded a single pixel that let her hackers “fingerprint” her computer, that is, identify …

… which operating system the computer is running, as well as which browser I was using, which browser add-ons I had, and which security software might be running on the computer.

That’s where Curtis’s tale turns scary. I recommend reading her article by clicking here. You might also check out this piece by Kevin Roose, who “dared two expert computer hackers to ruin my life.” Roose reported, “If I had to give myself an overall digital security grade, I’d give myself an A-.” But then he found out that

… it didn’t matter how good my defenses were. Against a pair of world-class hackers, my feeble protections were about as useful as cardboard shields trying to stop a rocket launcher. For weeks, these hackers owned the hell out of me. They bypassed every defense I’d set up, broke into the most sensitive and private information I have, and turned my digital life inside out.

“Please hack the Pentagon”

According to the Infosec Institute, in the 1960s the word hacker originally meant

… someone dedicated to solving technical problems in machines in a different, more creative fashion than what is set out in a manual … “hacking” just intended to find out a quick way to evaluate and improve problematic systems that need to be optimized.

Yet the potential threat wasn’t hard to anticipate. The Unites States government routinely hired hackers to test online security as early as the 1960s and 70s. Despite such precautions, it caused no small stir when in 1990 three men not retained by the government were indicted for hacking into classified U.S. military data. Meanwhile, the 1983 movie War Games, with Matthew Broderick and Ally Sheedy, had already fanned the public’s fears.

War Games was highly fictionalized, but the threat of hacking is real and continues to grow. This is from Symantec’s 2016 Internet Security Threat Report:

In 2015, we saw a record-setting total of nine mega-breaches, and the reported number of exposed identities jumped to 429 million. But this number hides a bigger story. In 2015, more companies chose not to reveal the full extent of their data breaches. A conservative estimate of unreported breaches pushes the number of records lost to more than half a billion.

The threat of nefarious hacking has increased the demand for “ethical” hacking. Last year, a call went out from no less than the Pentagon seeking hackers to try to penetrate their defenses. Of course, applicants had to pass a background check. Even that’s a little unsettling, since more experienced, not-so-ethical hackers usually don’t bother submitting to background checks before setting to work. In any case, according to USA Today, the program …

… launched in April and the Pentagon said it would [offer] prize money awards and other recognition … The Pentagon has acknowledged that its networks are under daily assault by hackers and securing the systems are [sic] a high priority. Last year, an email system used by the Joint Chiefs of Staff was penetrated by hackers and had to be taken offline in order to cleanse the system.

Somewhere in all of this are important takeaways:

- Vigilance is a must. Even with good security in place, you must never assume you’re invulnerable.

- Most of us have no clue as to the sophistication of determined hackers.

- Just opening an email can be dangerous, even without clicking on links.

It creates something of a juggling act for an industry like banking, whose markets demand digital services. The trick is to keep clients forewarned and forearmed while avoiding frightening them so much as to lose their confidence. Perhaps paradoxically, the proper presentation of information on staying safe from hackers can increase client confidence by conveying that a financial institution is knowledgeable and cares about its customers.

In the meantime, a bit of good advice for us all is summed up in this cartoon, which, out of respect for copyright laws, I shall not post. But I can link to it.

Sep 20

21

Congrats to Jane Fraser (but equity is still a long way off)

Like the rest of the world, I’m delighted with Citi’s announcing Jane Fraser as its next CEO. Still, as is often the case with great news, irony underlies the announcement. We are, after all, commemorating the centennial of the Nineteenth Amendment. One would have hoped that by now “major bank names female CEO” would be banal, not news.

But news it is. As Emily Flitter and Anupreeta Das last week for the New York Times, …

Booms and busts and scams and panics have changed Wall Street in many ways over the decades, but one thing has stubbornly remained the same: The top jobs have always gone to men. Now, that last citadel is about to fall … Ms. Fraser’s ascension is groundbreaking on Wall Street, which has never quite shaken off its longstanding reputation as a boys club.

“Never quite shaken off its longstanding reputation” is, I think, being generous. More accurately, Wall Street has not yet ceased deserving it. I’ll hasten to add that glass ceilings are by no means limited to banking. What they do seem limited to is the highest-paying careers.

“Why don’t you go into sports?”

NPR’s “Wait Wait Don’t Tell Me” host Peter Sagal summed up the issue well last week when, referencing the recent gender reveal party that sparked a wildfire, he quipped, “Back in the day, you’d reveal a baby’s gender by waiting till it grew up, joined the work force, and then you’d see how much it gets paid.”

To Sagal’s point, even in 2020, women overall make about 81¢ for every dollar men make. That number rises to 98¢ within verticals, a fact that lazy thinkers, motivated reasoners, and misogynists use to defend the status quo. The overall disparity, they’ll tell you, exists simply because women tend to opt for lower-paying careers. This overlooks the obvious follow-up question: If it’s true that women opt for lower-paying careers, why?

In fact, “opt” is the wrong word. It’s probably more accurate to say that society, academia, and business—not necessarily by design—still steer women toward lower paying careers. There is a prevailing myth, fueled by popular but ill-informed books, that women are intrinsically better at some tasks and men at others. Such would have readers believe that women emerge from the womb pre-ordained for lower-paying careers. (How convenient for men!) Surely this has some influence on boys’ and girls’ respective self-concepts as they grow up and eventually seek work.

The myth influences employers, too. Consider a 1999 study that Professor of History and Philosophy of Science at The University of Melbourne Cordelia Fine, PhD, cited in her book Delusions of Gender:

In one recent study more than 100 University psychologists were asked to rate the CVs of Dr. Karen Miller or Dr. Brian Miller, fictitious applicants for an academic tenure-track job. The CVs were identical apart from the name. Yet strangely, the male Dr. Miller was perceived (by both male and female reviewers) to have better research, teaching, and service experience than the luckless female Dr. Miller. Overall, about three-quarters of the psychologists thought that Dr. Brian was hireable, while only just under half had the same confidence in Dr. Karen.

Perception finds its way into practice in other ways. Noted astronomer Pamela Gay, PhD, observed:

It’s often hard for women and minorities to rise to positions of power—to break through that glass ceiling … where the constant downpouring of belittling comments and jokes plays a destructive role in self confidence. At my university, I’ve heard tenured faculty laugh that there is a policy not to hire women into tenure track physics positions. They do this in front of the junior faculty. I’ve heard people joke that the reason I’m in a research center rather than in physics is because I have boobs. It’s all said with a laugh.

People of color face similar societal roadblocks. The world’s most famous astrophysicist, Neil deGrass Tyson, encountered opposition as a boy when he set his sights on a career in science. The incident was recounted in The New Yorker:

At the age of eleven, Tyson spoke with a teacher … about his fascination with astronomy. Tyson’s older brother, Stephen, who is an artist, recalls, “The teacher asked, ‘Why do you want to go into science? There aren’t any Negroes in that field. Why don’t you go into sports?’”

Headway

To its credit, the industry has been trying of late. The Financial Brand’s President and CEO Jeffry Pilcher recently noted:

Some banks have started accepting the unfairness of the situation, and how things must change. Bank of America, BNY Mellon, Wells Fargo and Citi are among those who have announced a corporate commitment to equal pay for all, regardless of gender or ethnicity. To take it another step, hiring managers at Bank of America can no longer ask how much job candidates made at their last job as a means to further bridge any pay gaps.

It’s anyone’s guess as to whether the industry’s coming to terms with inequity is due to social consciousness, PR-mindedness, or a growing awareness that women make up half of the market and, increasingly, control significant funds. Either way, we have a long way to go before equity becomes a reality. Nor will it be easy. Though exclusion can arguably come about on its own, inclusion usually happens only by design, backed by vigilance and commitment.

In short, kudos to Fraser, and to Citi.